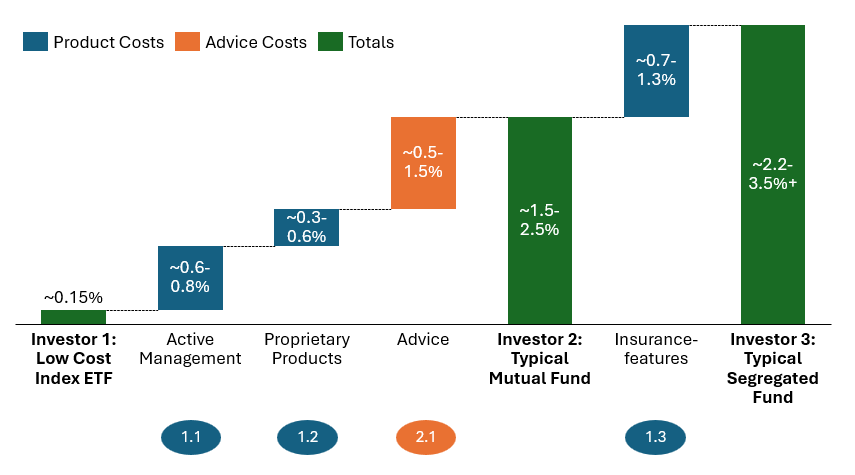

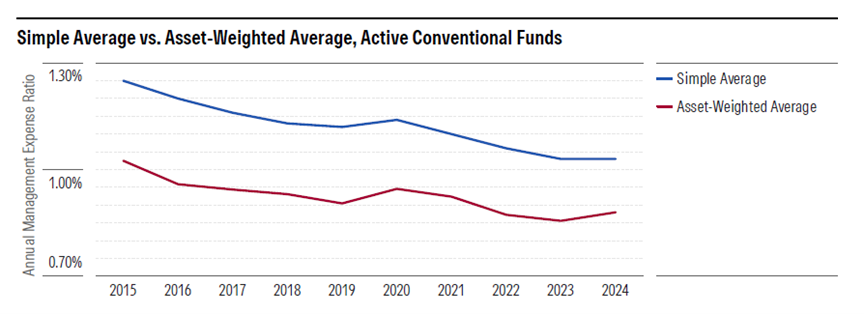

Active investing costs most Canadian investors at least .7% in additional fund management expense ratio per year with limited value. These funds also tend to have higher other expenses such as trading spreads and taxes, despite this and over 80% of Canadian Investments remain in actively managed funds.

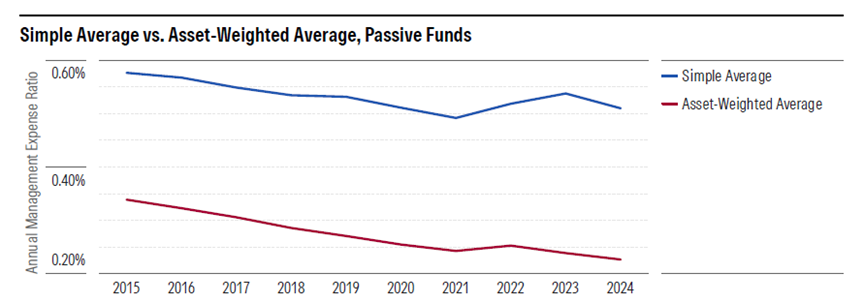

Passive investments are gaining traction in Canada, but so too are private investments or “alternatives” such as private credit and private equity which also involve active management and typically significantly higher fees (especially for retail investors).

1.2) Proprietary, higher cost products sold to customers within an often captive distribution channel

This is the really challenging part of the asset management landscape in Canada (and I think the root cause of why so many Canadians are skeptical of financial institutions). An integral part of the profit model of large banks, insurance companies, and many asset managers is incentivizing or requiring their staff to recommend investment products that are also manufactured by that same organization, often at a higher cost to the investor.

This is often but not always combined with active management, however if investors do manage to buy a passive index portfolio from many of the large asset managers they will likely still pay significantly higher fees by using the institution’s product rather than a comparable independent passively managed product.

Please note we are not endorsing specific securities but consider this example: (this pattern persists across Canadian asset managers). VCN.TO is a Canadian Equity Index ETF with a MER of 0.06%, whereas the Scotiabank Canadian Equity Index Fund (BNS581.CF) has very comparable equity exposure but has a MER of 0.55%. That’s 0.5% of additional product/admin costs.

1.3) Embedded “insurance-like” features such as principal guarantees and death benefits

This deserves a post on its own, but as a general rule products sold by insurance companies that combine investment and insurance features come at a significantly higher cost than purchasing insurance and investments separately. For example Segregated Funds sold by insurance companies include insurance-like features such as guaranteeing 75% or 100% of the principle over a period of often 10 years or in the event of death of the policy holder. These funds often have MERs in excess of 3% and additional sales charges and commissions to cover the cost of advice. Segregated funds often also include the costs of active management, and proprietary products but the insurance features add an additional ~0.7-1.2% in further costs.

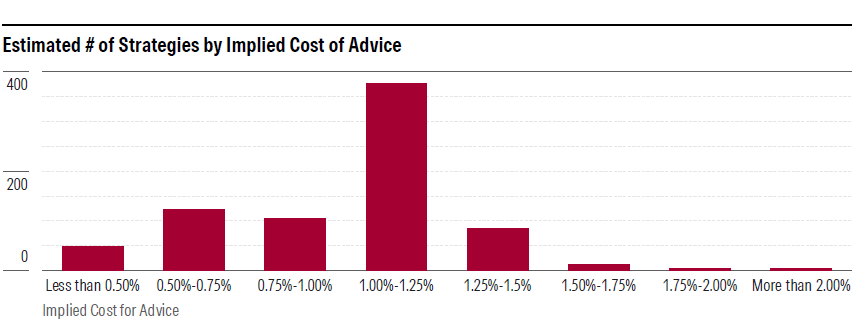

2.1) The cost of advice

Interestingly the cost of advice in Canada is reasonably concentrated around 1% of assets under management despite the level of service varying significantly, see chart 3 below.

Chart 3: Passive investment management costs for all Canadian funds (excluding share classes where the cost of advice is embedded)

Source: Morningstar 2025 Fee study